1. Forms of Capital Contribution, Share Purchase, and Equity Acquisition by Foreign Investors

The term “capital mobilization” refers to the process of acquiring additional assets from multiple investors to sustain long-term business operations and expand investment activities. Not all enterprises possess sufficient capital for sustained operations, making mobilized capital critical for scaling business activities under favorable conditions.

Capital contribution, share purchase, and equity acquisition enhance an enterprise’s competitiveness, particularly as product quality and consumer demands continue to rise. To meet these demands, enterprises must focus on operational efficiency and demonstrate progress through business performance metrics. With sufficient capital, enterprises can implement strategies to promote products, invest in new technologies, and improve product quality to meet consumer needs. Thus, attracting foreign investment through share purchases and equity contributions is of paramount importance.

2. Legal Framework for Capital Contribution, Share Purchase, and Equity Acquisition by Foreign Investors in Vietnam

2.1. Forms of Investment

Foreign investors are permitted to invest in Vietnam through capital contribution, share purchase, or equity acquisition, as stipulated in the Investment Law 2020. Additionally, Clauses 4 and 5 of Article 65 of Decree No. 31/2021/ND-CP specify that foreign investors must comply with conditions outlined in Clause 2, Article 24 of the Investment Law, including:

– Market access conditions for foreign investors, such as the ownership ratio in the charter capital of economic organizations.

– Investment forms, scope of investment activities, investor capacity, and partners involved, as per Articles 15, 16, and 17 of Decree No. 31/2021/ND-CP.

Under Article 25 of the Investment Law 2020, foreign investors may contribute capital through:

1. Purchasing shares issued for the first time or additional shares of a joint-stock company, as only joint-stock companies are permitted to issue shares under the Enterprise Law. Foreign investors may purchase dividend-preferred or redeemable preferred shares, subject to approval by the General Meeting of Shareholders or company charters. Each type of share grants equal rights and obligations to investors.

2. Contributing capital to limited liability companies or partnerships. Limited liability companies may increase charter capital through contributions from existing or new members. Partnerships may accept new general or limited partners as per current regulations.

3. Contributing capital to other economic organizations not covered by the above cases.

Capital contribution, share purchase, or equity acquisition resulting in foreign investors or economic organizations (as defined in Points a, b, and c, Clause 1, Article 23 of the Investment Law) holding over 50% of the charter capital occurs in cases such as:

– Increasing foreign investors’ ownership from 50% or below to above 50%.

– Increasing ownership when foreign investors already hold over 50% of the charter capital.

2.2. Rights and Obligations of Foreign Investors

2.2.1. Rights of Foreign Investors

Foreign investors enjoy rights similar to domestic investors, such as participating in the issuance of ordinary shares, becoming shareholders, attending and voting at General Meetings of Shareholders, receiving dividends, and transferring shares as per regulations. Foreign investors face no restrictions on rights compared to domestic investors.

Foreign investors may engage in business activities not prohibited by law. For conditional business sectors, they must comply with specified conditions. Article 33 of the 2013 Constitution stipulates that freedom of business is a fundamental right, allowing individuals to engage in lawful industries. Similarly, Article 7 of the Enterprise Law 2020 grants enterprises the freedom to operate in non-prohibited sectors and choose their organizational structure.

Foreign investors may select their preferred investment form under Article 21 of the Investment Law 2020, applicable to both domestic and foreign investors. However, the lack of explicit provisions for foreign investors can pose challenges for those investing in Vietnam for the first time.

In limited liability companies or partnerships, foreign investors who become capital contributors enjoy rights equivalent to domestic members, such as profit-sharing proportional to their capital contribution and transferring their equity as detailed in Clause 1, Article 187 of the Enterprise Law 2020.

Foreign investors may dispose of their capital contributions or equity by transferring part or all to others, as stipulated in Clause 1, Article 49, and Clause 1, Article 187 of the Enterprise Law 2020 for limited liability companies and partnerships, respectively.

2.2.2. Obligations of Foreign Investors

Foreign investors must:

– Comply with conditions specific to the type of economic organization they invest in.

– Fulfill payment obligations for capital contributions or share purchases.

– Ensure the accuracy, truthfulness, and legality of investment registration documents.

– Meet financial obligations as required by law.

3. Practical Application of the Legal Framework

Despite expanding legal frameworks creating opportunities for investors, foreign investors face challenges in identifying the 84 restricted industries, including 25 industries with no market access and 59 with conditional access, as per Decree No. 31/2021/ND-CP. Complex procedures and lengthy processing times can hinder cost and time calculations.

Decree No. 31/2021/ND-CP, replacing Decree No. 108/2006/ND-CP, lacks clarity in defining foreign investors’ rights and obligations. As a result, enterprises receiving foreign capital negotiate rights and obligations individually, highlighting the need for clearer legal provisions to ensure long-term, stable foreign investment.

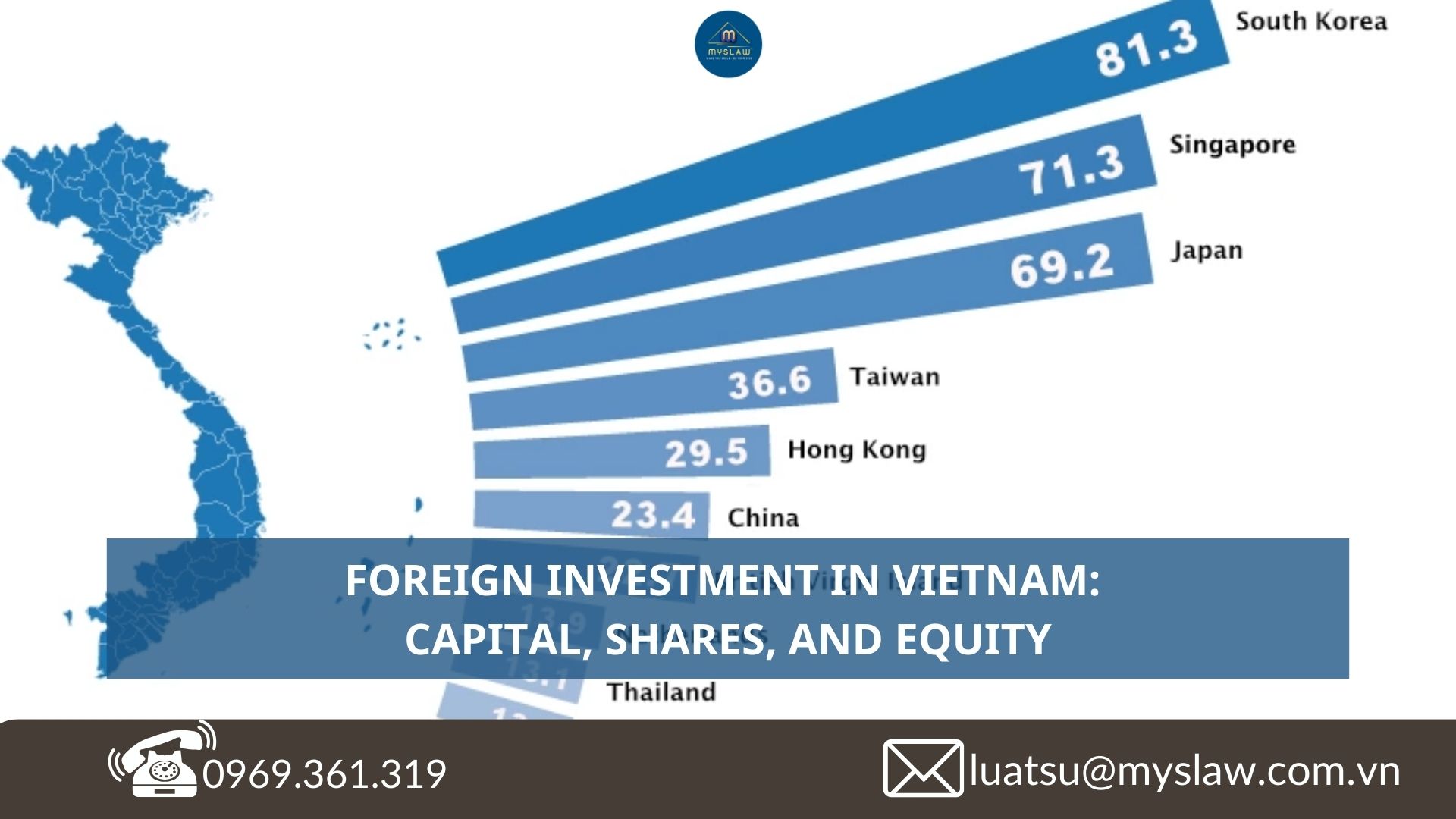

Vietnam is increasingly attractive to major investors from Europe, the U.S., and other regions, who view it as a promising investment destination. However, improving the investment environment remains critical to retaining investors.

4. Recommendations for Legal Improvements

To enhance the legal framework for foreign investment, the following recommendations are proposed:

1. Clarify Definitions: The Investment Law 2020 defines foreign investors as individuals with foreign nationality or organizations established under foreign law. However, it does not explicitly address whether branches or representative offices of foreign enterprises can invest in Vietnam. As no provisions prohibit such entities, they should be permitted to invest, but clearer regulations are needed.

2. Enhance Legal Dissemination: Authorities should promote investment laws through diverse channels such as books, newspapers, and online platforms. Official websites of the Ministry of Planning and Investment and the Government should provide timely updates on investment laws and detailed procedures for foreign investors.

3. Improve Regulatory Capacity: Enhancing the expertise of regulatory authorities is crucial. This includes not only professional qualifications but also skills in guiding investors through procedures, along with certifications in IT and English to handle foreign investors’ applications efficiently.

4. Address Partnership Restrictions: Clause 2, Point c, Article 25 of the Investment Law 2020 allows foreign investors to purchase equity in partnerships to become limited partners but not general partners. Meanwhile, Clause 3, Article 180 of the Enterprise Law 2020 permits equity transfers with the consent of other general partners but does not specify whether foreign investors can become general partners. This gap should be addressed to allow foreign investors to assume general partner roles under clear conditions.

5. Conclusion

Vietnam’s market is increasingly attractive to foreign investors, but legal limitations persist. Further amendments and supplements are needed to refine the legal framework governing foreign investors’ rights and obligations, particularly for capital contribution, share purchase, and equity acquisition. Leveraging Vietnam’s political and social stability, alongside addressing legal gaps, will enhance its appeal as an investment destination. Annual investment statistics reflect growing interest and positive developments in these investment forms, underscoring the need for continued legal improvements to sustain and expand foreign investment.

The above information is provided by Mys Law. For any questions regarding the content of this article, please contact 0969.361.319 or email: [email protected] for further clarification. Best regards!

Compiler: Nguyen Anh Quan