Establishing a business in Vietnam requires compliance with tax obligations under the Law on Tax Administration 2019, the Law on Corporate Income Tax, the Law on Value-Added Tax, and related decrees. This consultation outlines the primary taxes applicable to a newly established enterprise in 2025.

The business license tax, or lệ phí môn bài, is an annual mandatory tax for enterprises and individuals engaged in business activities, as stipulated by the 1983 Ordinance on Industrial and Commercial Taxes. The tax rate depends on the registered charter capital: VND 3,000,000 per year for capital exceeding VND 10 billion, VND 2,000,000 for capital between VND 5 billion and VND 10 billion, VND 1,500,000 for capital from VND 2 billion to under VND 5 billion, and VND 1,000,000 for capital below VND 2 billion. All entities involved in production, trading, or service provision must pay this tax. New enterprises are exempt in their first year, with payment due by July 30 if the exemption ends in the first half of the year, or January 30 of the following year if it ends in the second half.

Corporate Income Tax (CIT) is levied on taxable profits after deducting allowable expenses, as defined by the Law on Corporate Income Tax. The standard tax rate is 20%, though rates may range from 32% to 50% for industries like oil and gas or rare resource extraction. Taxable income is calculated as total revenue minus deductible expenses plus other taxable income. Entities generating taxable income, including foreign organizations operating in Vietnam without establishment under the Law on Investment or Enterprise Law, are subject to CIT. Provisional CIT payments are due quarterly before the 30th day of the month following the quarter’s end, with annual settlements due by the last day of the third month after the fiscal year-end.

Value-Added Tax (VAT) is an indirect tax on the added value of goods and services, borne by consumers but remitted by businesses, as per the Law on Value-Added Tax 2008. Enterprises with annual revenue of VND 1 billion or more, or those voluntarily registered, use the deduction method, where VAT payable is output VAT minus input VAT, with rates of 0%, 5%, or 10% depending on the goods or services. Enterprises with revenue below VND 1 billion or non-compliant with accounting standards use the direct method, where VAT is calculated as taxable revenue multiplied by a ratio (1% for goods distribution, 5% for services or construction without material supply, 3% for manufacturing or transportation, and 2% for other activities). Entities providing taxable goods or services in Vietnam, except exempt items, are subject to VAT. Monthly filings are due by the 20th of the following month, while quarterly filings are due by the 30th or 31st of the first month of the subsequent quarter.

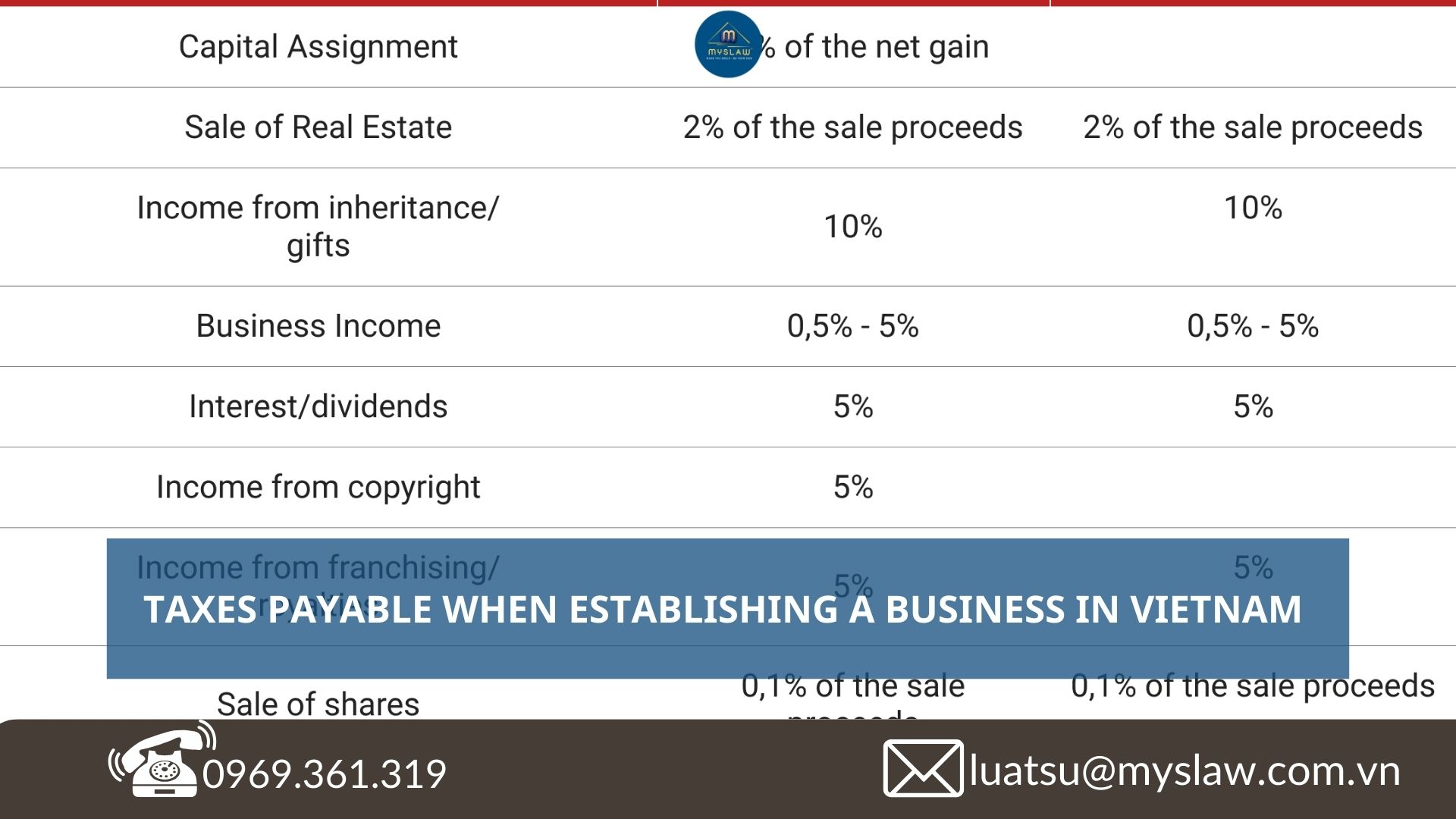

Personal Income Tax (PIT) is withheld by enterprises on behalf of employees’ salaries, as per the Law on Personal Income Tax 2007. PIT is calculated monthly on taxable income using progressive rates: 5% for income up to VND 5 million, 10% for VND 5-10 million, 15% for VND 10-18 million, 20% for VND 18-32 million, 25% for VND 32-52 million, 30% for VND 52-80 million, and 35% for income above VND 80 million. Deductions include VND 11 million per month for the taxpayer, VND 4.4 million per dependent, and mandatory insurance contributions. Individuals with monthly taxable income exceeding VND 11 million are subject to PIT, with payments due by the 10th day following the income-generating event.

Depending on business activities, enterprises may also be subject to additional taxes. Resource tax applies to entities exploiting natural resources, calculated based on quantity and prescribed rates. Export-import tax is levied on goods crossing Vietnam’s borders, determined by quantity, taxable value, and tax rate or a fixed amount per unit. Special consumption tax targets specific goods and services like tobacco, alcohol, and gasoline, calculated as the taxable price multiplied by the tax rate. Environmental protection tax is imposed on environmentally harmful products such as fuels and plastic bags, calculated as quantity multiplied by a fixed tax per unit. Non-agricultural land use tax applies to land used for residential, industrial, or commercial purposes, calculated as land area multiplied by land price and tax rate.

Tax filing and payment occur at the State Treasury, tax authorities, or authorized agencies like commercial banks, as per Article 56 of the Law on Tax Administration 2019. Payments can be made directly or electronically, with receipts provided and funds transferred to the state budget within 8 working hours, or as regulated for remote areas. New enterprises must open a corporate bank account, register an electronic signature for e-tax filing, and choose a VAT calculation method (deduction or direct) before the first tax declaration deadline to ensure compliance.

In 2025, new enterprises benefit from a business license tax exemption in their first year but must adhere to strict filing and payment deadlines to avoid penalties, such as late payment interest at 0.03% per day under Decree 118/2023/ND-CP. Businesses in sectors like construction or resource extraction should account for additional taxes, while those in high-tech or renewable energy may qualify for CIT incentives under Decree 218/2013/ND-CP. Proper tax management, including timely registration and accurate filings, is essential to avoid legal and financial consequences. Enterprises are advised to engage professional tax advisors or accounting services to ensure compliance with Vietnamese tax laws.

The above information is provided by Mys Law. For any questions regarding the content of this article, please contact 0969.361.319 or email: [email protected] for further clarification. Best regards!

Compiler: Nguyen Anh Quan